Economic analysis spanning decades of data shows raising tipped minimum wage requirements (slashing tip credits) brings consequences for servers’ and bartenders’ jobs and income, and restaurants’ ability to keep their doors open.

Recently, anti-tip credit activists have targeted various states across the country, including several neighboring states in New England. There are currently active tip credit elimination measures proposed in Massachusetts, Connecticut, and Rhode Island. Nearby New York is also contemplating its own bills to fully eliminate the tip credit there.

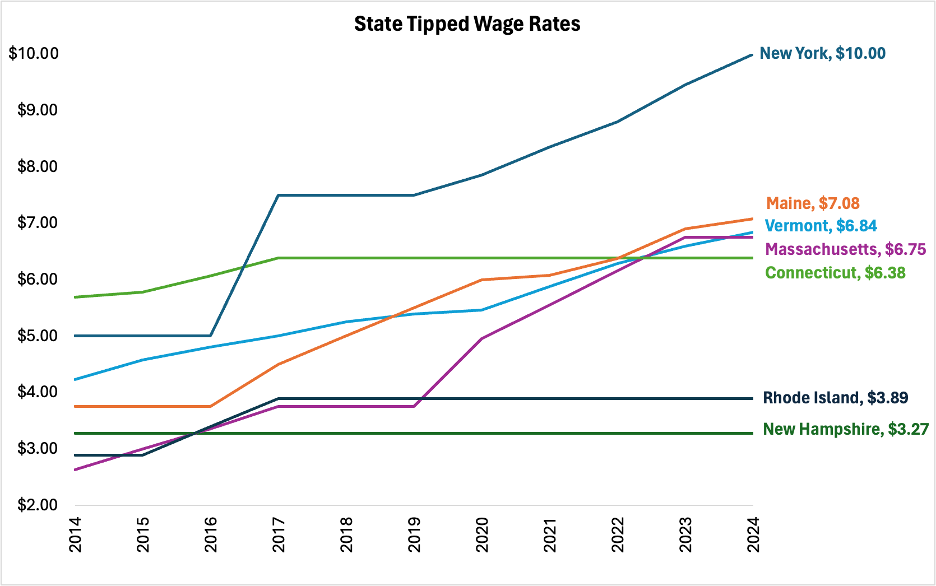

These states have taken different approaches to raising their tipped wage rates over the last decade. Maine, Vermont, Massachusetts, Connecticut and New York have all taken the annual increase approach, while New Hampshire and Rhode Island have had minimal increases to keep the tipped wage constant. Employees in these states are all covered by the respective state minimum wage laws, which require all employees earn at least the regular minimum wage when tips are added to the base wage.

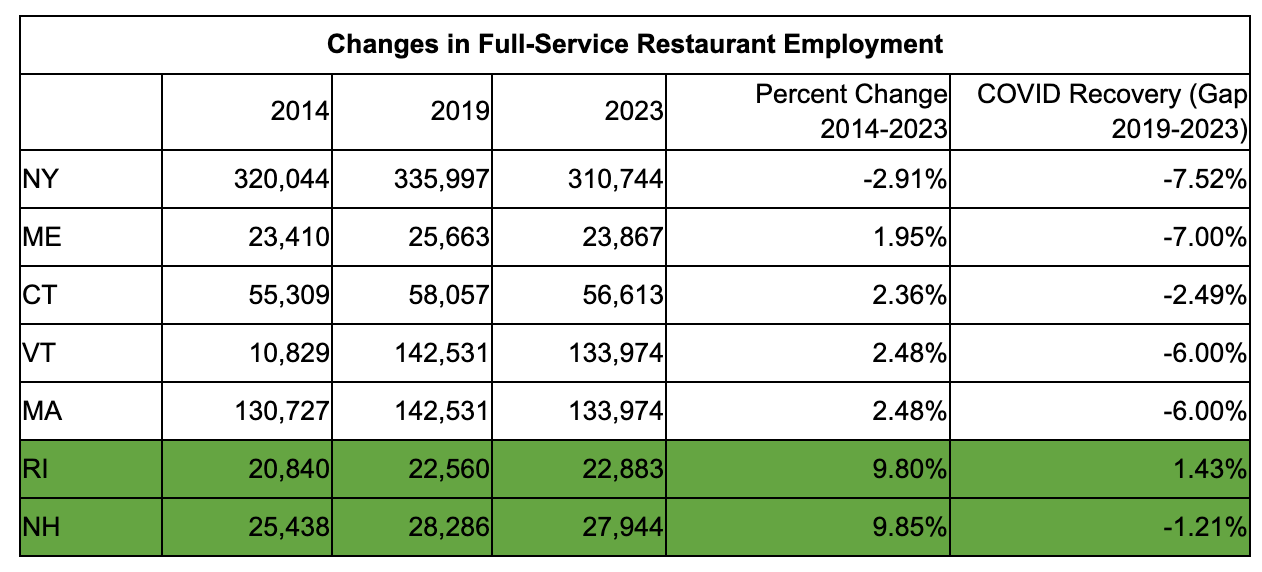

A new look at federal data shows even states’ campaigns to annually raise the tipped wage and reduce the size of the tip credit have taken a toll on affected jobs. Maine, Vermont, Massachusetts, Connecticut, and New York have seen sluggish growth in full-service restaurant employment, with New York actually losing restaurant jobs in the last decade. On the contrary, New Hampshire and Rhode Island, which have kept their tipped wages constant, have experienced double-digit full-service restaurant employment growth.

Even before considering new proposals to fully eliminate the tip credit in these New England states, this data cautions that campaigns to raise the tipped minimum wage have already hurt the tipped workforce.

*Latest available for 2023 is through September, so this figure represents an average of monthly employment levels from January-September 2023.

States that have incrementally increased their tipped minimum wage have seen limited full-service restaurant employment growth (Maine, 1.95%; Connecticut, 2.36%; Vermont, 2.48%; Massachusetts, 2.48%) since 2014, and in the most extreme cases have seen significant job losses for affected employees (New York, -2.91%). Based on the latest available data, these states also failed to recover COVID-related job losses in the full-service restaurant industry; all five states in 2023 had industry employment levels 6% or more below December 2019 levels.

On the contrary, states that have kept their tipped wage constant have seen nearly double-digit full-service restaurant employment growth over the same period (Rhode Island, 9.8%; New Hampshire, 9.85%). Rhode Island has rebounded from COVID job losses and surpassed 2019 industry employment levels, while New Hampshire’s current employment level is roughly 1% lower than in 2019.

As these and other states across the country consider tip credit elimination or even just downsizing tip credits, federal data shows even marginal reductions can cause significant harm in the industry. States like Rhode Island and New Hampshire should not follow their neighbors’ footsteps, and any state with some level of tip credit should consider the damage prior tipped wage hikes have already done before instituting more mandates.