Last week, New Hampshire Governor Chris Sununu signed legislation to sever the tie between the state’s minimum base wage for tipped employees and the federal minimum wage, which the state currently adopts as its own minimum requirement for all non-tipped employees.

As President Biden and Congressional allies continue pushing for a federal $15 minimum wage, New Hampshire legislators were right to stick up for their restaurant industry. A recent blog on the effects of the recently proposed (and killed) Raise the Wage Act details the negative consequences ending the tip credit could have on the Granite State – over 4,800 jobs lost for tipped employees alone.

Restaurant servers and bartenders have vocally opposed the push to eliminate tip credits, not only because of harmful employment effects, but also because the current system provides sustainable income, and doesn’t need to be “fixed” by harmful federal mandates.

Earlier this year, New Hampshire servers from the Copper Door Restaurant in Bedford, New Hampshire started a grassroots effort to save the federal tip credit amid the debate over the Raise the Wage Act earlier this year, with nearly 800 signatures petitioning:

“If the tip credit is removed, many restaurants will eliminate tipping and move to an hourly wage system. Tipped employees would likely earn far less than they currently do and restaurants would be forced to reduce employee hours or operate with fewer employees.”

Following the grassroots campaign, New Hampshire’s U.S. Senators Maggie Hassan and Jeanne Shaheen followed the evidence and supported the tipped employees in their state by voting against the Raise the Wage Act:

“Tipped restaurant employees in New Hampshire were not asking for this; in fact, most are against it as they make more in tips than the minimum wage, including the proposed hike to $15 per hour.” (NH Business Review)

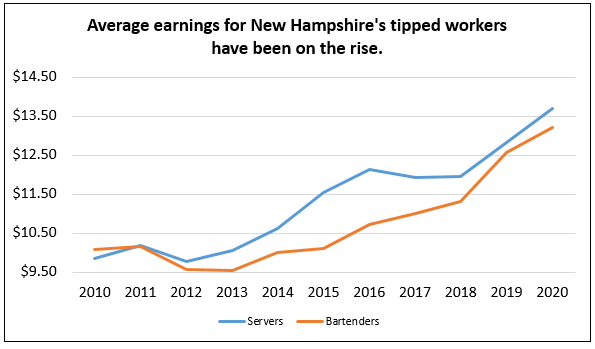

Why do tipped employees themselves support tipping and the tip credit? Earnings data shows New Hampshire servers and bartenders are actually earning more than double the current minimum wage on average, and those facing no-tipping models in other areas have rejected this alternative payment system.

- Tips provide a standard of earning that far exceeds the regular minimum wage.

- Economic analysis of Current Population Survey data spanning 2007 to 2017 finds that New Hampshire’s average earnings for servers and bartenders, when tips are factored in, were $15.16 per hour. With tips, the Granite State’s tipped workforce already makes well beyond the current federal minimum wage.

- The Bureau of Labor Statistics provides base estimates up to May 2020 through its Occupational Earnings and Wage Statistics database. This data has been demonstrated to underreport total take home earnings due to its methodology — and may not fully represent the total amount of take-home pay employees make with all of their tips included. Yet even this lower average indicates tipped employees in New Hampshire are already earning much more than the minimum wage, a trend that has risen to equal nearly double the current federal wage in 2020.

- When employers either choose or are required to switch to a no-tip credit model, they are required to leverage the new costs in other ways.

- The restaurant industry operates on razor-thin profit margins compared to many other industries, often 3-5%. Restaurant employers are forced to evaluate the tradeoffs of rising wages due to the elimination of the tip credit, and have been demonstrated to reduce the number and scheduled hours of tipped staff, raise prices, and even close altogether.

- Restaurant owners who switched to paying their traditionally-tipped employees from a base wage plus tips to a flat minimum wage found they had to raise prices, either through a menu price increase or a service surcharge.

- In this way, an anti-tip credit payment model can become an anti-tipping model. Restaurants shifting to a flat wage may notify guests that tipping is optional or included in their bill, to alleviate customers’ sensitivity to the higher menu prices, reducing tip percentages.

- Servers in restaurants utilizing a no-tip credit model largely reject the payment system because it reduces their earnings, due to reduced tips, reduced hours and even layoffs, due to rising costs to the restaurant and customers.

- After Thad Vogler’s San Francisco restaurants switched to a flat minimum wage payment system, servers reported earning $20 per hour; but prior to the change, servers reported earning as high as $40 per hour with their tips.

- Danny Meyer’s NYC restaurants lost as many as 40% of his front of house staff after moving toward a no-tipping system, where staff reported the shift was “painful” financially.

The decoupling of the tipped wage from the federal minimum wage standard represents another victory for New Hampshire’s tipped employees. Lawmakers must continue to stand up to out-of-state interests that threaten the jobs and livelihoods of the Granite State’s tipped restaurant employees.