In 2022, lawmakers in Hawaii approved a bill to put Hawaii’s minimum wage higher than any other state in the country: to reach $18 per hour by 2028. The state also has a minimal tip credit allowance for restaurant employers to count $1.25 in tips toward the higher minimum wage requirement.

Yet as the hourly minimum wage has bumped up $2 per year for the last two years, Aloha State businesses, including restaurants, are begging for relief.

Hawaii maintained a $7.25 minimum wage (and $7.00 tipped wage) starting in 2007 up until 2015. That year instead, Hawaii raised its minimum wage up to $7.75 an hour (raising the tipped wage to $7.15). While the state has had a historically small tip credit, its increases in the regular minimum wage rate in the last decade have caused an 82% spike in the tipped wage up to $12.75 per hour.

Economists have presented evidence spanning decades that drastic increases in minimum and tipped minimum wages cause employees to lose their jobs, and even force businesses closed. Others have found wage hikes contribute to rising inflation. The effects are particularly devastating for leisure and hospitality industries, which employ the majority of minimum wage employees, and restaurants, which employ the majority of tipped employees.

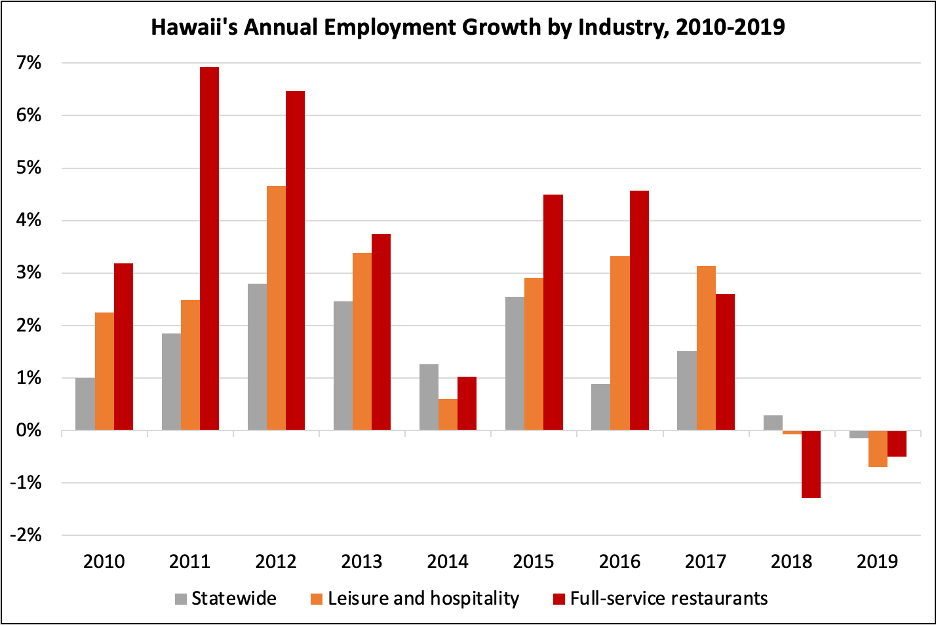

Data on annual employment growth shows policies of ever-increasing wage rates have taken a toll on Hawaii’s affected industries. Prior to the job loss caused by the pandemic, Hawaii’s steep wage hikes and slashed tip credit took a toll on employment in Leisure and Hospitality, particularly in full-service restaurants.

One business owner cited the “compounding increases taking place” in Hawaii are making it hard for businesses to stay in operation. Another claimed the already-existing shortage of employees would be made worse by future minimum wage hikes, saying “we don’t want to lose our valued, established employees.” Others have stated they will be forced to raise prices or reduce their staff’s scheduled hours to accommodate the state’s most recent increase up to $14 per hour.

As mounting inflation, spiking operating costs, and other concerns including ongoing recovery from wildfires in Maui in 2023 loom for business owners across the state, lawmakers should be wary of the additional harm scheduled wage hikes could do to Hawaii’s economy. Even worse, inaction with regards to the tip credit could exacerbate the acute negative impacts of wage hikes on Hawaii’s beloved restaurants.