Sen. Bernie Sanders’ Raise the Wage Act proposed to raise the minimum wage to $15 nationally, and also eliminate the tip credit, raising the tipped minimum wage also to $15. Currently, states across the country vary in allowing tip credits to account for substantial tip income. States like California, Washington, and Oregon contain some of the highest wage rates in the country and also do not allow employers to use any tip credit to account for employees’ tip income.

Tipped employees across the country have successfully advocated to save the tip credit, and their traditional tipping model, because of its substantial earning and flexible employment opportunities. On the other hand, evidence from the west coast states of California, Washington, and Oregon shows paying servers and bartenders one flat wage costs jobs, reduces tip income, and triggers restaurant closures.

Tipped employees in high-wage west coast areas experience lower levels of employment than tipped employees in states with more robust tip credits.

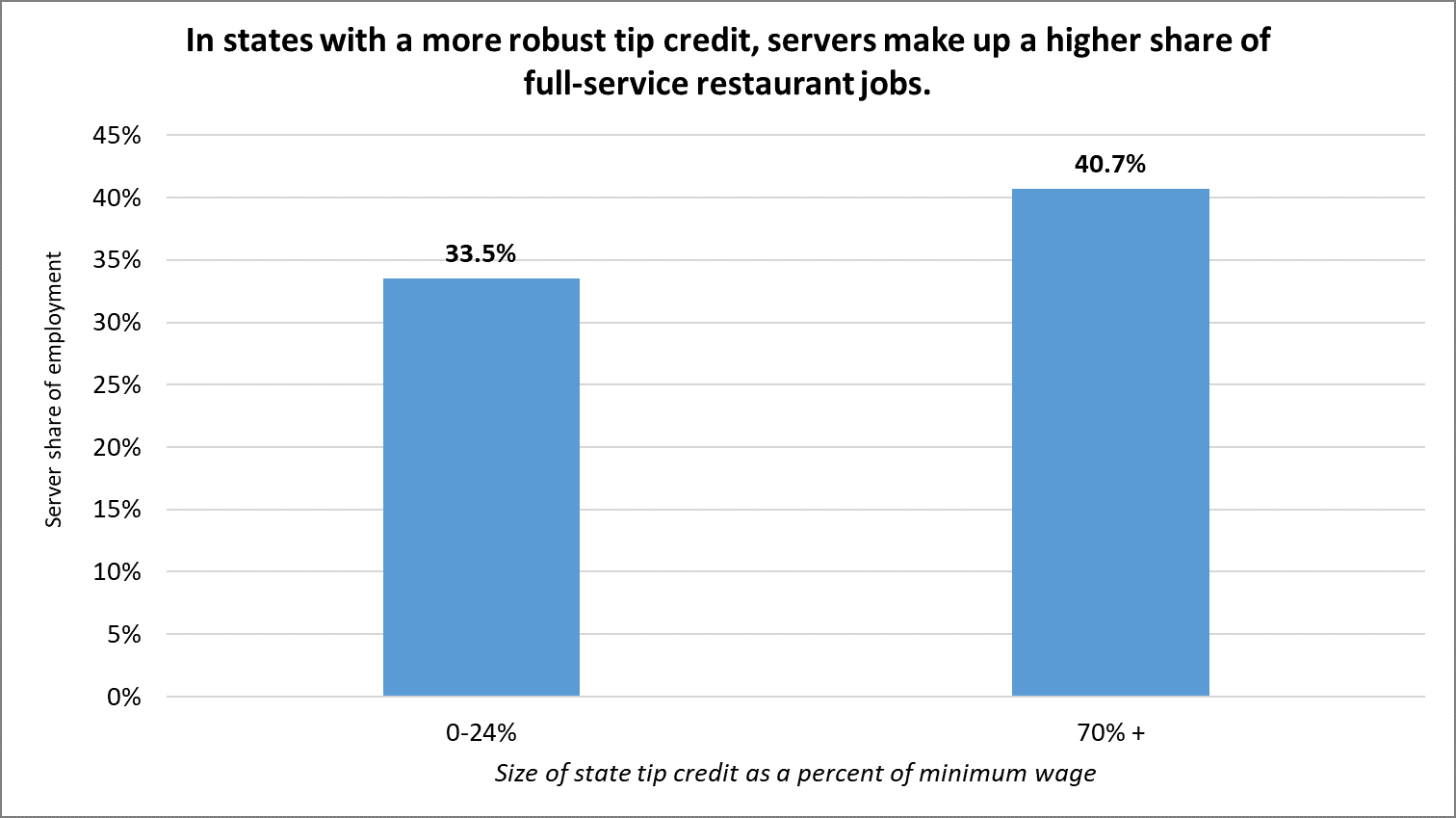

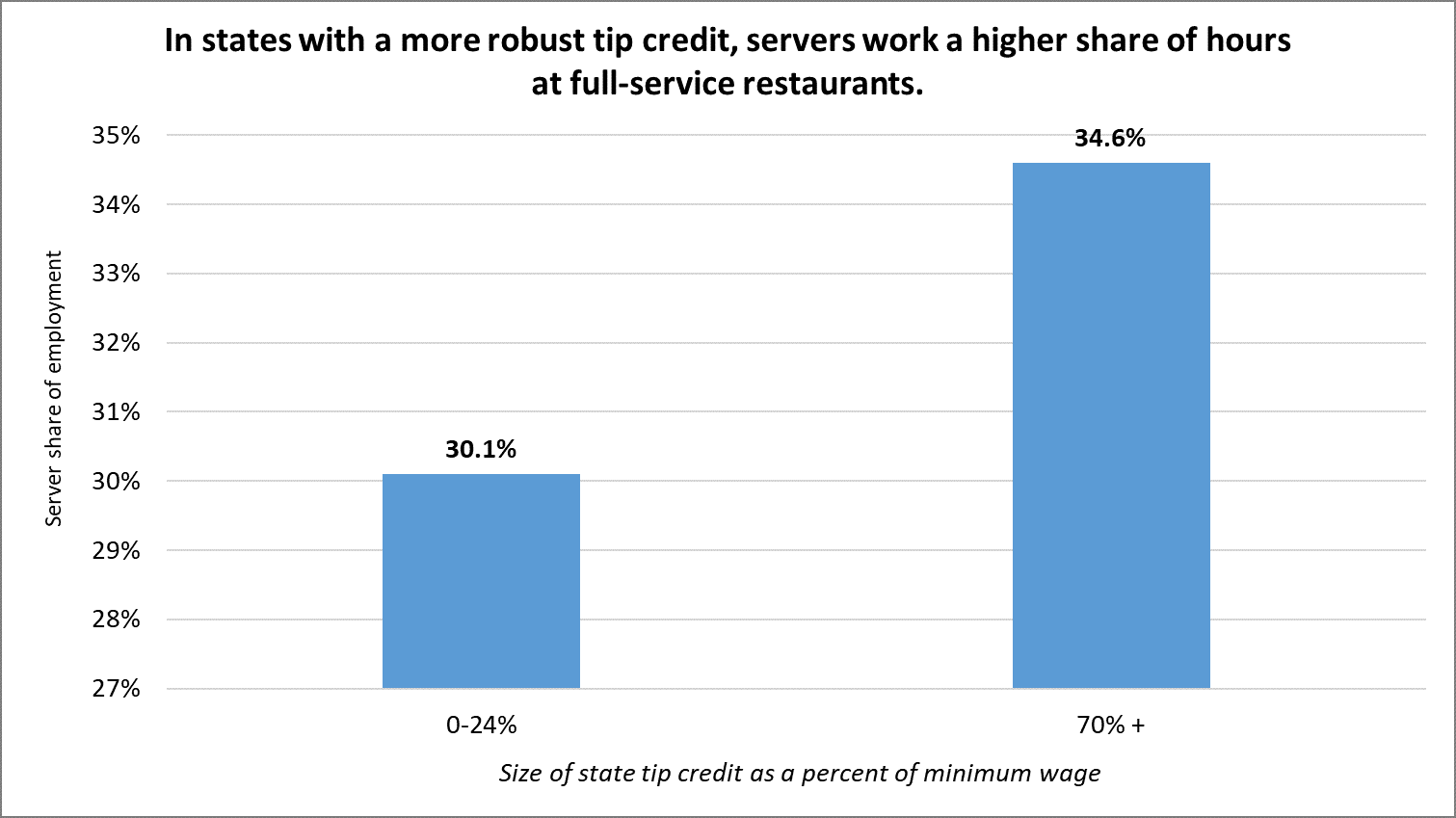

- Analysis by economists from Miami and Trinity Universities finds that servers in states with minimal to no tip credits represent an 18 percent lower share of full-service restaurant employment and 19 percent fewer hours than in states with larger tip credits. The economists conclude that even as new restaurants open in these states, they employ fewer tipped workers, who work fewer hours, than in states with healthier tip credits.

Additional research on the West Coast cases finds that cutting down or eliminating the tip credit also affects earnings for tipped employees and causes businesses to close.

- A University of Washington study on the impact of Seattle’s minimum wage ordinance found that the city’s 2016 increase to $13 reduced hours worked in low-wage jobs (including tipped jobs) by 9 percent – even as Seattle’s total hours worked rose by 15% during the same period. Despite hourly wage increases, total payroll fell for these jobs, by an average of $125 per month.

- This aligns with a nationwide analysis by the U.S. Census Bureau, which determined that based on state-level variation in the size of the tip credit, every increase in the tipped minimum wage (and therefore decrease in the tip credit) corresponded with a decrease in tip earnings of the same proportion.

- A Cornell University study also concludes that states with higher tipped minimum wages experience lower average tip percentages in restaurants (including those like California, Oregon, and Washington which have no tip credit).

- A Harvard Business School study concluded that every $1 increase in San Francisco’s minimum wage corresponded with a 14% increase in likelihood of median-rated restaurant closure.

- A study conducted by city officials in Emeryville (one of the highest-wage cities in California and the country) found that restaurants were struggling to remain open following implementation of annually-indexed wage minimum wage hikes. The results found most food service businesses in operation in 2015 (when the increases were adopted, which also applied to tipped workers) were not still operating in 2019. An additional survey of restaurants in the city found that more than half had decreased workers’ scheduled hours, and one-third had cut employment in response to the raises.

This evidence is corroborated by restaurant and employee experiences in west coast cities.

- San Francisco restaurateurs and business owners bemoaned the city’s “death by a thousand cuts” for the restaurant industry, which included “insurmountable” minimum wage costs and other mandates – which increased employer costs by 52 percent since 2012. In a public comment period on proposals to alleviate obstacles on restauranteurs and their employees, one chef stated: “…we’ve started to see San Francisco as a non-viable market.”

- Additional coverage of San Francisco’s restaurant woes portrayed similar results: Eater San Francisco likened the vast restaurant closures due to rising minimum wages and other mandates a “death march.” The Wall Street Journal reported that the city’s restaurants were cutting down on service staff to accommodate the mandates, if not forced to close – describing San Francisco as a “cautionary tale.” The San Francisco Chronicle documented that restaurant prices were far outpacing inflation, in large part due to rising labor costs.

- A Seattle server reported that due to annually-rising minimum wages in Seattle, with no tip credit allowances, her employer would be forced to close: “Instead of receiving a bigger paycheck, I’m left without any pay at all due to the policy change.”